FAQs on Form No. 27 and Timelines following the 2024 Amendments

The Office of the Controller General of Patents, Designs & Trademarks (CG’s Office) has released a set of Frequently Asked Questions (FAQs) regarding Form-27 or the Working Statement requirements under the Patents Act, 1970 (referred to hereafter as the Patents Act).

The CG’s office received multiple communications from various stakeholders requesting the issuance of guidelines or FAQs concerning the requirement for a “statement regarding the working of a patented invention on a commercial scale in India” (Working Statements), as outlined in Form-27, particularly in relation to the recently notified Patents Amendment Rules, 2024.

A public virtual meeting on this matter was also held on 29th July 2024. Following this, the CG’s office has issued FAQs related to Form-27 or the Working Statement requirements under the Patents Act. Frequently Asked Questions (FAQs) on Form No. 27 under the Patent Act and timelines for various scenarios post the 2024 amendment is provided to clarify that a single Form-27 can be submitted to provide details for multiple patents, provided these patents are related and granted to the same patentee(s).

Here are some key details regarding Form-27 from the FAQs:

What is Form 27 (Working Statement of granted patents)

Form 27 (working statement of granted patents) is a mandatory requirement for the granted Patents to furnish the information whether the Patent has been worked or not under Section 146(2) of the Patents Act, 1970 (as amended) and Rule 131(1) of the Patents Rules, 2003.

Who needs to file Form-27

Every patentee and every licensee in India shall file Form-27.

Deadline to file Form-27

Form 27 is required to be filed at the Indian Patent Office once in respect of every period of three financial years commencing right after the financial year in which the patent has been granted.

What information is required in filing Form 27

Form 27 is required to be provided with below information in case of working or non-working of the patent:

If Patent is worked: The Patentee has to affirm only that the patent has been worked.

If Patent is not worked: The Patentee has to affirm that the patent has not been worked followed with choosing the below provided reasonings or may provide any specific reason if any:

- Patented Invention is under development/ commercial trial

- Patented Invention is under Review/approval with Regulatory authorities

- Exploring commercial licensing

- Any other, may specify

New Amendment in the Form 27

- Earlier the Form 27 was required to be filed for each financial year commencing right after the financial year in which the patent has been granted on or before the 30th of September of the commencing financial year.

- With the recent amendments now, the Form 27 is required to be filed once in respect of every period of three financial years commencing right after the financial year in which the patent has been granted on or before the 30th of September of the commencing financial year.

- Provision to extend the timeline of submission of Form 27 in accordance with rule 131(2) and 138 of the Amended Patent Rules, 2024.

Additional change in the Form 27

- The Patentee can now provide their contact information in the Form 27 in case interested in receiving communications from any person interested in seeking a license.

- A single Form 27 can be filed for multiple granted patents in case the patentee is same.

Penalty on non-compliance of the requirement of Form 27 for the granted patents]

The Form 27 is mandatory requirement under Section 146(2) of the Patents Act, 1970 (as amended) and Rule 131(1) of the Patents Rules, 2003. In case of failure in compliance of the requirement or providing false statement or information, then in accordance with Section 122 the patentee shall be punishable with fine which may extend to ten lakh rupees or punishable with imprisonment which may extend to six months, or with fine, or with both.

Timeline and procedure to fulfil the requirement of Form 27

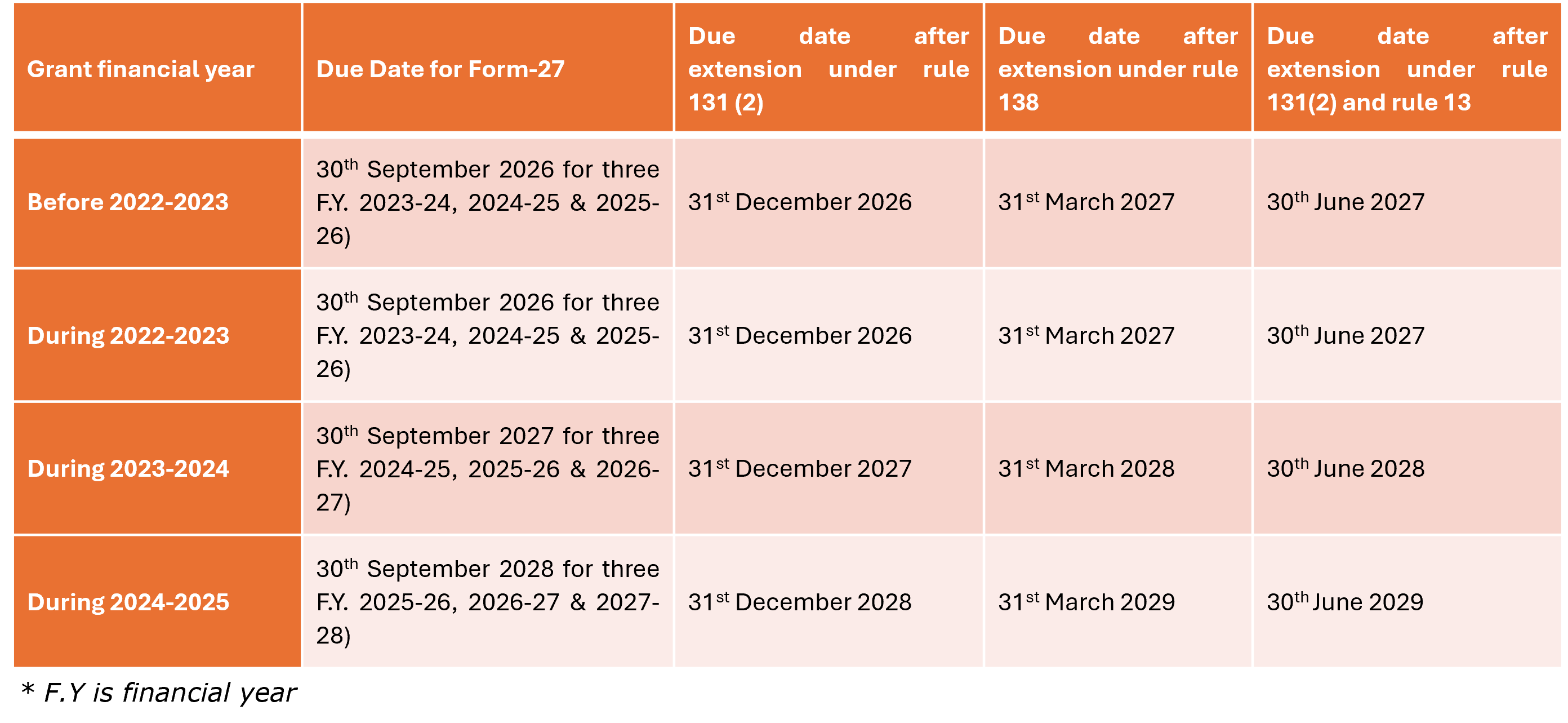

- In accordance with the recent amendments dated March 15th, 2024, the patents granted before /during / after the financial year 2022-23 can be filed as pern below:

The patents granted before financial year 2022-23: If the Patentee has filed Form 27 for financial year 2022-23 (If not, the Form 27 for the missed financial year is required to be filed before hand). The Form 27 is required to be filed once in respect of period of three financial years 2023-24, 2024-25 and 2025-26 on or before the 30th of September 2026. - The patents granted during financial year 2022-23: The Patentee is required to file Form 27 once in respect of period of three financial years 2023-24, 2024-25 and 2025-26 on or before the 30th of September 2026.

- The patents granted after the financial year 2022-23 (i.e., during F.Y 2023-24 and after): The Patentee is required to file Form 27 once in respect of period of three financial years 2024-25, 2025-26 and 2026-27 on or before the 30th of September 2027.

For example:

Provision to extend the timeline for filing Form 27

- The timeline for filing Form 27 can be extended for 3 months by filing Form 4 under Rule 131(2) along with the prescribed official fee of INR 2,000 (for Natural Person /Start up /Small Entity / Educational Institution) or INR 10,000 (for other than natural person) per month.

- In pursuant to the filed Form 4 extending the timeline maximum 3 months) the deadline to file Form 27 can be further extended by 06 months (in addition to the timeline already extended in pursuant to filed Form 4 under Rule 131(2)) by filing request under Rule 138 along with the prescribed official fee of INR 10,000 (for Natural Person /Startup /Small Entity / Educational Institution) or INR 50,000 (for other than natural person) per month.

- In case Patentee/Licensee has failed to avail an extension of three months by filing Form 4 under rule 131(2), the deadline for filing Form-27 still can be extended by 6 months from the last date of filing of Form 27 by filing request under rule 138 along with the prescribed official fee of INR 10,000 (for Natural Person /Startup /Small Entity / Educational Institution) or INR 50,000 (for other than natural person) per month.

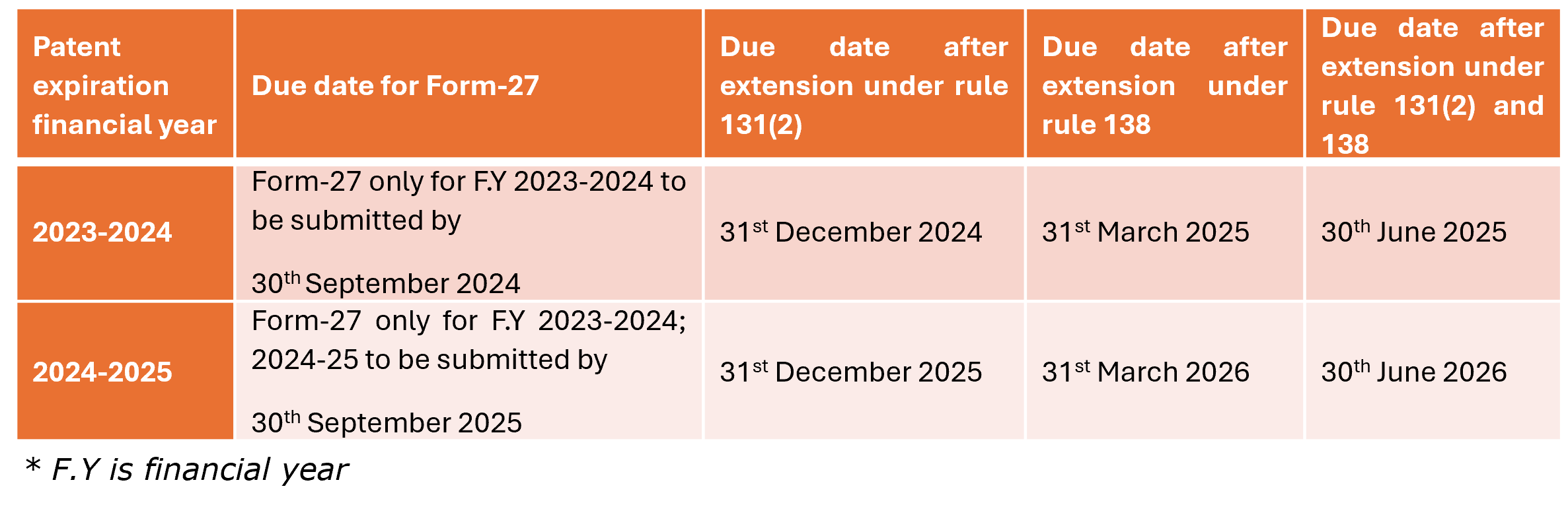

The FAQs also provide detailed scenarios for patents that will expire in the financial years 2023-24 and 2024-25:

- Form-27 is due on September 30, 2024, specifically for patents that expired during the financial year 2023-2024.

- For all patents granted before March 31, 2023, the deadline to file Form-27 is September 30, 2026, unless the patents either expired in the financial year 2023-2024 or will expire in the financial year 2024-2025.

Is it possible to condone a delay in filing Form-27?

No, a petition under Rule 137 for condoning delay in filing is not permitted.

Are there any options available for filing Form-27 if the deadline expired before the commencement of the Patents (Amendment) Rules, 2024?

None. It is not possible to file Form-27 if the due date had passed before the Patents (Amendment) Rules, 2024 came into effect.

Can multiple stakeholders (like patentees, exclusive or non-exclusive licensees) file Form-27 separately for same patent or a group of patents?

Yes. Patentees and exclusive or non-exclusive licensees can file Form-27 separately for the same patent or a group of patents.